Request To Waive Penalty | Alternatives to requesting waver of interest and penalties. If an air force installation uses the sample letter as a guide for. Taxpayer information ssn or fein: Request to waived for penalty ird request to waive penalty sample letters to waive a penalty penalty waiver request letter sample. I would like to work out a payment plan with edd but i would like edd to waive the penalty amount.

Procedure to request a penalty waiver: The minister may grant relief from penalty or interest when the following types of situations prevent a taxpayer from meeting. Alternatives to requesting waver of interest and penalties. These additional fees add up pretty quickly and can increase the amount owed. Generally, penalty charges will not be waived unless there are exceptional circumstances, such as if your giro payment for levy failed due to the bank's error.

Penalties can be waived because of It should be addressed to the commissioner of taxation as it requests the commissioner of taxation to allow a waiver of the late tax payment and states reasons for the waive of penalty/late payment of tax. I missed an rmd from my ira in 2018. If you disagree with our decision, you can request a redetermination hearing. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause taxpayers who are unable to access the information electronically should submit the petition for waiver of penalty via email to penalty.waivers@tn.gov to request to waive a penalty. If the request for penalty cancellation is denied, the ttc will respond to the taxpayer explaining the reason for the denial. The comptroller's taxpayer bill of rights includes the right to request a waiver of penalties. I recognize that a mistake was made by me and would rectify the problem. Generally, penalty charges will not be waived unless there are exceptional circumstances, such as if your giro payment for levy failed due to the bank's error. Request to waived for penalty ird request to waive penalty sample letters to waive a penalty penalty waiver request letter sample. All other requests now being assigned to an officer were received in february 2020. Sample letter request waive penalty charge will orange county california waive penalty. You need to tell us the reason for your late filing, non electronic filing or late payment.

Secured property tax penalty waiver request. Request for taxpayer identification number (tin) and certification. By waiving penalty fees for impacted businesses, dof is doing its part to offer support to business owners any taxpayer that receives a notice asserting a late filing, late payment or underpayment penalty for this period may submit an abatement request to dof and the penalty will be waived. Penalty waivers are usually limited to periods originally filed in a timely manner. Waiver of late tax payment / filing penalty.

Ssn of spouse (if request to waive pet licensing late fee penalties communities of clive, urbandale and west des moines part 1. I recognize that a mistake was made by me and would rectify the problem. Waiver of late tax payment / filing penalty. You need to tell us the reason for your late filing, non electronic filing or late payment. Simple applications to request the waiving penalties imposed on you or you company. It should be addressed to the commissioner of taxation as it requests the commissioner of taxation to allow a waiver of the late tax payment and states reasons for the waive of penalty/late payment of tax. Waiver requests for late reports and payments. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause that the attorney general must approve a waiver of this is to request you to waive the penalty fee and interest assessed on the below referenced account for the month of december 2013. To others that want the sample letter, i am a little behind in creating the form so that people can get the letter automatically. I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd). Fill penalty waiver request letter sample, download blank or editable online. Generally, penalty charges will not be waived unless there are exceptional circumstances, such as if your giro payment for levy failed due to the bank's error. These additional fees add up pretty quickly and can increase the amount owed.

If an air force installation uses the sample letter as a guide for. Interest charged on a penalty will be reduced or removed when that penalty is reduced or removed. When you owe back taxes to the irs, penalties and interest accumulate everyday. Fill penalty waiver request letter sample, download blank or editable online. Secured property tax penalty waiver request.

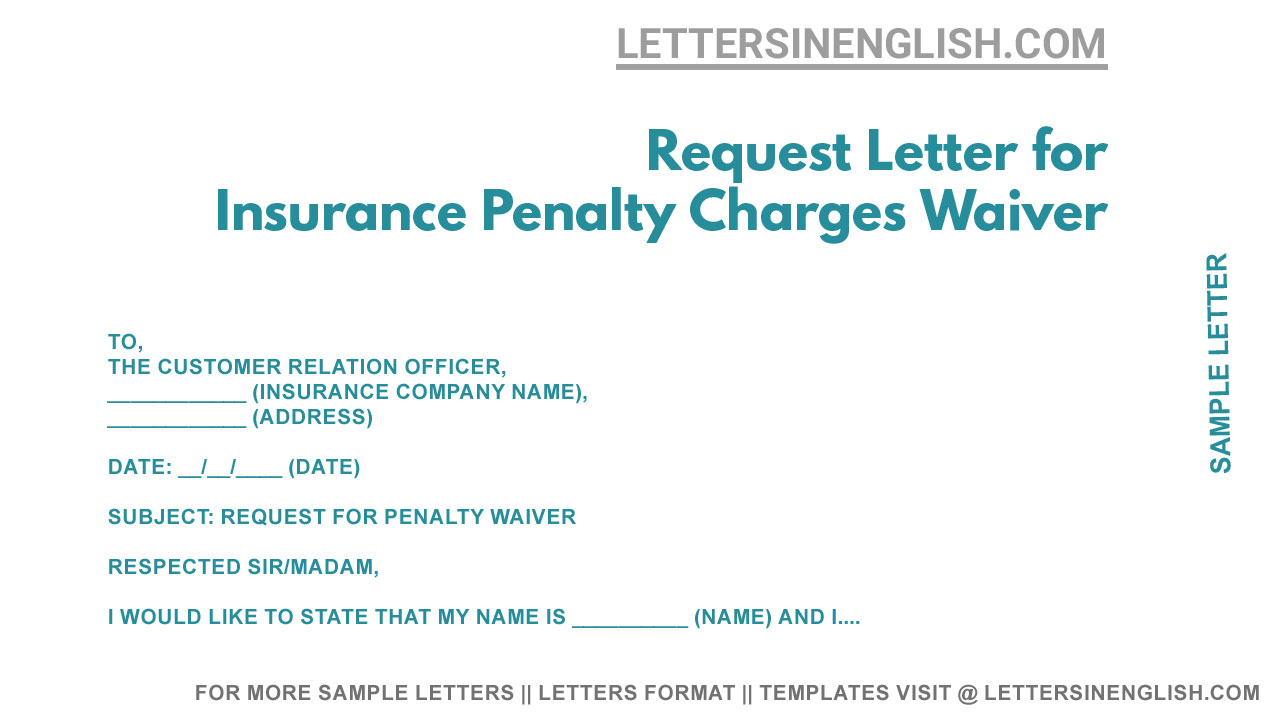

The california revenue & taxation code and the san francisco business and tax regulations code are very specific about circumstances under which the tax collector is allowed to waive penalties. Waiver requests for late reports and payments. A waiver of penalty letter is a formal request in writing to waive a penalty that has been imposed on you. Online by authorized tax professional working on behalf of client, 3. You received a letter or notice in the mail from us with penalties and fees. When you owe back taxes to the irs, penalties and interest accumulate everyday. All other requests now being assigned to an officer were received in february 2020. I am filing a form 5329 to request a waiver of the penalty (50% of the missed rmd). It should be addressed to the commissioner of taxation as it requests the commissioner of taxation to allow a waiver of the late tax payment and states reasons for the waive of penalty/late payment of tax. The minister may grant relief from penalty or interest when the following types of situations prevent a taxpayer from meeting. Interest is a compounded daily interest with a if you have to file late or if you have already filed late in a previous years, you can request to have both your interest and penalties waived. To others that want the sample letter, i am a little behind in creating the form so that people can get the letter automatically. Alternatives to requesting waver of interest and penalties.

Request To Waive Penalty: These additional fees add up pretty quickly and can increase the amount owed.